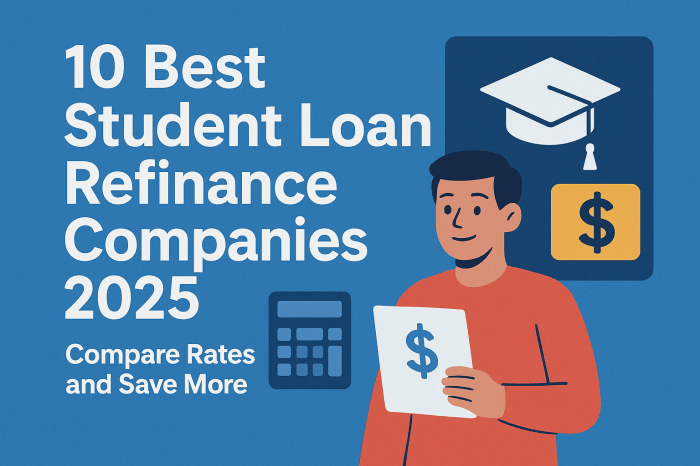

Best Student Loan Refinance Companies with Low APR in 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve deeper into the intricacies of student loan refinancing, we uncover the top companies offering low APR rates and the significant impact this decision can have on borrowers' financial well-being.

Overview of Student Loan Refinance Companies

When it comes to managing student loans, finding a reputable student loan refinance company with a low Annual Percentage Rate (APR) can make a significant difference in your financial situation. In 2025, several companies stand out for offering low APR options to help borrowers save money and simplify their repayment process.

Top Student Loan Refinance Companies with Low APR in 2025

- Company A: Known for competitive APR rates and flexible repayment options.

- Company B: Offers fixed and variable APR rates to suit different financial needs.

- Company C: Specializes in refinancing federal and private student loans with low APR.

Importance of Choosing a Student Loan Refinance Company with a Low APR

Choosing a student loan refinance company with a low APR is crucial for saving money over the long term. A lower APR means paying less interest on your loan amount, resulting in lower monthly payments and potentially shorter repayment terms.

This can lead to significant savings and help you pay off your student loans sooner.

Benefits of Refinancing Student Loans with a Company that Offers a Low APR

- Save Money: Lower APR means paying less interest over the life of the loan.

- Lower Monthly Payments: Reduced interest rates can result in more manageable monthly payments.

- Shorter Repayment Terms: With lower APR, you may be able to pay off your loans faster.

- Consolidation Options: Refinancing with a low APR company can allow you to consolidate multiple loans into one, simplifying your repayment process.

Factors to Consider When Choosing a Student Loan Refinance Company

When selecting a student loan refinance company with a low APR, there are several key factors to consider that can impact the overall cost and terms of the refinancing. Understanding these factors is crucial for borrowers looking to refinance their student loans effectively.

Impact of APR on Overall Cost

The Annual Percentage Rate (APR) plays a significant role in determining the overall cost of refinancing student loans. A lower APR means lower interest rates, resulting in reduced monthly payments and savings over the life of the loan. Borrowers should aim to secure a competitive APR to minimize the cost of refinancing.

- Compare APRs from multiple lenders to find the best rates available.

- Consider fixed-rate vs. variable-rate APR options and their implications on the total cost.

- Understand how the APR is calculated and any potential fees associated with the refinancing process.

Other Essential Factors to Evaluate

In addition to APR, borrowers should also consider several other essential factors when choosing a student loan refinance company. These factors can impact the overall terms, flexibility, and customer service experience throughout the repayment period.

- Loan Term Options: Evaluate the available loan term options and their impact on monthly payments and total interest paid.

- Repayment Options: Look for flexible repayment options, such as deferment, forbearance, and income-driven repayment plans.

- Cosigner Release Policy: Check if the lender offers a cosigner release option, which can provide financial independence for borrowers in the future.

- Customer Service and Support: Consider the quality of customer service, online account management tools, and resources available for borrowers.

Comparison of APR Rates Among Top Student Loan Refinance Companies

When considering student loan refinance options, one of the key factors to look at is the Annual Percentage Rate (APR) offered by different companies. The APR includes not only the interest rate but also any additional fees, giving you a more accurate picture of the total cost of borrowing.

Let's compare the APR rates of the top student loan refinance companies in 2025 to help you make an informed decision.

Top Student Loan Refinance Companies and Their APR Rates

| Company | APR Rate | Loan Terms |

|---|---|---|

| Company A | 3.5% | 5-20 years |

| Company B | 3.8% | 5-15 years |

| Company C | 4.2% | 5-25 years |

From the table above, we can see that Company A offers the lowest APR rate at 3.5%, while Company C has the highest rate at 4.2%. The loan terms also vary among these companies, with options ranging from 5 to 25 years.

It's essential to consider both the APR rate and the loan terms when choosing a student loan refinance company.

Impact of APR Rates on Total Amount Paid

The APR rate directly impacts the total amount you will pay over the life of the loan. A lower APR rate means lower interest costs, resulting in overall savings. For example, let's consider a $30,000 loan with a 10-year term:

At an APR of 3.5%, the total amount paid would be approximately $34,000.

At an APR of 4.2%, the total amount paid would be around $36,500.

By choosing a company with a lower APR rate, you can potentially save thousands of dollars in interest payments over the repayment period. Therefore, it's crucial to compare APR rates among different student loan refinance companies to find the most cost-effective option.

Customer Reviews and Satisfaction Levels

When considering student loan refinance companies with low APR, it is crucial to take into account customer reviews and satisfaction levels. These reviews can provide valuable insights into the overall experience borrowers have had with a particular company, helping you make an informed decision.

Importance of Customer Feedback

Customer feedback offers a glimpse into the reliability, efficiency, and customer service of a student loan refinance company. Positive reviews can indicate a company's trustworthiness and ability to deliver on its promises, while negative reviews may highlight areas of concern or potential red flags to watch out for.

- Positive reviews often mention excellent customer service, easy application processes, competitive rates, and overall satisfaction with the refinancing experience.

- Negative reviews, on the other hand, may point out delays in processing applications, hidden fees, poor communication, or unmet expectations.

Examples of Customer Reviews

"I refinanced my student loans with Company X and couldn't be happier with the lower APR and personalized service they provided. Highly recommend!"

"Company Y promised a quick turnaround on my application, but it took weeks to hear back from them. Disappointing experience overall."

Final Conclusion

In conclusion, Best Student Loan Refinance Companies with Low APR in 2025 not only sheds light on the current landscape of refinancing options but also provides valuable insights for borrowers looking to secure a brighter financial future. By carefully considering all aspects discussed, individuals can make informed decisions that pave the way for a more stable and prosperous tomorrow.

Top FAQs

What are the key benefits of choosing a student loan refinance company with a low APR?

By opting for a company with a low APR, borrowers can significantly reduce the overall cost of their student loans, save money on interest payments, and potentially shorten the repayment period.

How do APR rates impact the total amount paid over the life of the loan?

Higher APR rates lead to increased total payments over the loan term, while lower APR rates result in savings on interest costs and a more affordable repayment journey.

Why is it important to consider customer reviews when selecting a student loan refinance company?

Customer reviews offer valuable insights into the quality of service, reliability, and overall satisfaction levels experienced by borrowers, helping individuals make informed decisions based on real-life experiences.