As Debt Financing Meaning: How It Shapes Corporate Capital Structure takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The content of the second paragraph that provides descriptive and clear information about the topic

Definition of Debt Financing

Debt financing refers to the practice of a company raising funds by borrowing money from external sources rather than issuing equity. This form of financing involves the company taking on debt that must be repaid over time, usually with interest.

Examples of Debt Financing Instruments

- Bank Loans: Companies can secure loans from banks to finance their operations or expansion.

- Corporate Bonds: Companies can issue bonds to investors, promising to repay the principal amount along with interest at a later date.

- Convertible Notes: These are loans that can be converted into equity at a later stage, offering flexibility to both the company and the investor.

Importance of Debt Financing in Shaping Capital Structure

Debt financing plays a crucial role in shaping a company's capital structure by providing an alternative to equity financing. By utilizing debt, companies can benefit from tax advantages, maintain ownership control, and leverage their existing assets to raise capital. However, excessive debt can increase financial risk and interest expenses, impacting the company's overall financial health and stability.

Types of Debt Financing

Debt financing provides various options for businesses to raise capital by borrowing money. Let's explore the different types of debt financing and compare short-term versus long-term options.

Short-Term Debt Financing

- Short-term loans: These are typically used to cover immediate expenses or manage cash flow fluctuations. They have a shorter repayment period, usually less than a year.

- Trade credit: Businesses can obtain goods or services on credit from suppliers, allowing them to defer payment for a specified period.

Long-Term Debt Financing

- Bonds: Companies can issue bonds to investors, promising to repay the principal amount along with interest over a specified period.

- Bank loans: Long-term loans from financial institutions provide businesses with capital for expansion or large investments, with a repayment period exceeding one year.

Short-term debt financing offers quick access to funds but may come with higher interest rates, while long-term debt financing provides stability but requires a longer commitment.

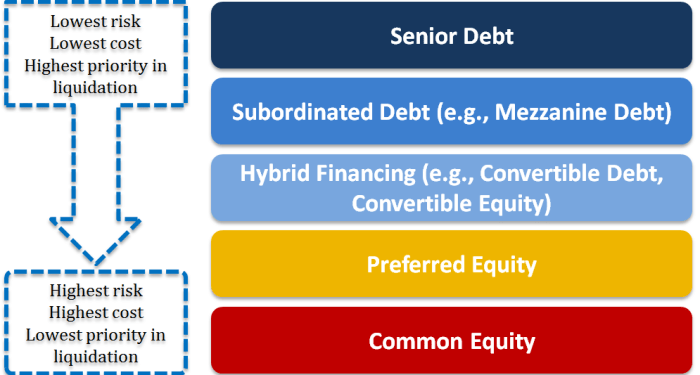

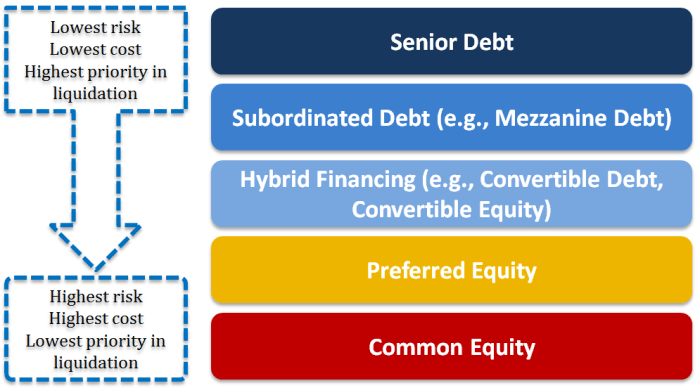

Role of Debt Financing in Capital Structure

Debt financing plays a crucial role in shaping a company's capital structure by influencing how a company funds its operations and investments. Companies often use a combination of debt and equity to finance their activities, and the mix of these two components can have significant implications for the financial health and risk profile of the company.

Influence on Financial Risk and Leverage

Debt financing impacts a company's financial risk and leverage by introducing fixed obligations in the form of interest payments and principal repayments. While debt can amplify returns for shareholders through financial leverage, it also increases the company's exposure to the risk of insolvency in case of financial distress.

Companies need to carefully manage their debt levels to balance the benefits of leverage with the risks associated with higher debt obligations.

Determining the Optimal Mix of Debt and Equity

Companies need to determine the optimal mix of debt and equity in their capital structure to achieve a balance between cost of capital, financial flexibility, and risk tolerance. The optimal capital structure varies depending on factors such as industry dynamics, growth prospects, and overall financial health.

By analyzing these factors, companies can make informed decisions on the appropriate level of debt financing to maintain a healthy and sustainable capital structure.

Debt Financing Strategies

Debt financing strategies play a crucial role in shaping the financial structure of a company. These strategies help companies manage their debt effectively, optimize their capital structure, and achieve their financial goals.

Factors Influencing Debt Financing Strategies

- Financial Goals: Companies need to consider their financial objectives when deciding on the amount of debt to take on. Whether the goal is to fund growth, increase shareholder value, or reduce costs, the level of debt should align with these objectives.

- Cost of Debt: Companies assess the cost of debt in comparison to other financing options. They need to ensure that the interest payments on the debt are manageable and do not strain the company's cash flow.

- Risk Tolerance: Companies vary in their risk tolerance levels, which influence their debt financing decisions. Some companies may prefer a more conservative approach with lower debt levels, while others may be comfortable taking on higher levels of debt to finance growth.

Industry-Specific Debt Financing Strategies

- Capital-Intensive Industries: Industries that require significant capital investments, such as manufacturing or infrastructure, may rely more on debt financing to fund their operations and expansion projects.

- Tech Startups: Startups in the technology sector often use a combination of equity and debt financing. They may opt for debt financing to fund research and development activities while preserving equity for future growth.

- Service-Based Companies: Companies in service-based industries, like consulting or marketing, may have lower debt levels as they have lower capital requirements. They may use debt financing for short-term working capital needs.

Final Review

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

General Inquiries

What is the impact of debt financing on a company's financial risk?

Debt financing can increase a company's financial risk as it involves obligations to repay debt, which can strain cash flows and affect overall financial stability.

How do companies determine the optimal mix of debt and equity in their capital structure?

Companies often consider factors like cost of capital, risk tolerance, and growth prospects to determine the right balance between debt and equity in their capital structure.

What are some common debt financing strategies used by companies?

Common strategies include refinancing debt to lower interest rates, issuing bonds to raise capital, and using asset-based lending to secure financing.