Delving into JEPI Stock Monthly Income Strategy: Passive Income for Retirees, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Providing a clear overview of what JEPI Stock Monthly Income Strategy entails, how it differs from traditional investment strategies, and the benefits it offers for retirees seeking passive income.

Introduction to JEPI Stock Monthly Income Strategy

JEPI Stock Monthly Income Strategy is a unique investment approach designed to provide retirees with a consistent and reliable source of passive income. Unlike traditional investment strategies that may focus on long-term growth or capital appreciation, this strategy aims to generate monthly income through dividend payments.

How JEPI Stock Monthly Income Strategy Differs

- JEPI Stock Monthly Income Strategy prioritizes regular income over capital gains, making it ideal for retirees seeking a steady cash flow.

- Unlike growth-focused strategies, JEPI Stock Monthly Income Strategy often includes dividend-paying stocks or other income-producing assets.

- This strategy aims to provide investors with a predictable monthly income stream, which can help cover living expenses in retirement.

Benefits of Using JEPI Stock Monthly Income Strategy

- Stable Income: By focusing on dividend-paying stocks, this strategy can offer a reliable source of income for retirees.

- Monthly Cash Flow: Instead of waiting for quarterly or annual dividend payments, investors can enjoy monthly income distributions.

- Diversification: JEPI Stock Monthly Income Strategy often involves a diversified portfolio of income-producing assets, reducing risk and enhancing stability.

Understanding Passive Income for Retirees

Passive income is income that is earned without active participation in earning it. This type of income is crucial for retirees as it provides a steady stream of money without the need to work actively. Passive income allows retirees to maintain their financial independence and support their lifestyle during retirement.

Common Sources of Passive Income for Retirees

- Rental Properties: Retirees can earn passive income by renting out properties they own. The rental payments serve as a regular source of income.

- Dividend-paying Stocks: Investing in stocks that pay dividends can provide retirees with a consistent income stream without the need to sell the stocks.

- Interest from Savings Accounts or Bonds: Retirees can earn passive income through interest earned on savings accounts or bonds they hold.

- Peer-to-Peer Lending: Retirees can lend money through online platforms and earn interest on the loans, generating passive income.

Examples of How Passive Income Can Support Retirement Lifestyle

- Supplementing Retirement Income: Passive income can supplement retirement savings and pension, providing retirees with additional financial security.

- Travel and Leisure: Passive income can fund travel and leisure activities during retirement, allowing retirees to enjoy their golden years without financial constraints.

- Healthcare Expenses: Passive income can help cover healthcare expenses, ensuring retirees have access to quality healthcare services when needed.

- Legacy Planning: Passive income can be used for legacy planning, allowing retirees to leave behind a financial legacy for their loved ones.

Overview of JEPI Stock Monthly Income Strategy Components

When it comes to the JEPI Stock Monthly Income Strategy, there are several key components that work together to generate monthly income for retirees. Understanding how these components interact is crucial for implementing this strategy effectively.

Components of JEPI Stock Monthly Income Strategy:

- Stock Selection: The strategy involves carefully selecting dividend-paying stocks with a history of consistent payouts. These stocks are typically from stable companies with a track record of financial performance.

- Dividend Reinvestment: Reinvesting dividends back into the same stocks or other investments helps to compound returns over time, increasing the overall income generated.

- Portfolio Diversification: Diversifying the stock portfolio helps to reduce risk and ensure a more stable income stream. This involves spreading investments across different sectors and industries.

- Monitoring and Adjustments: Regularly monitoring the performance of the stocks in the portfolio and making adjustments as needed is essential to maintain the desired level of income.

By combining these components effectively, retirees can create a reliable source of passive income to support their financial needs.

Benefits and Risks of JEPI Stock Monthly Income Strategy

When considering the JEPI Stock Monthly Income Strategy for retirees, there are several advantages and risks to take into account.

Advantages of JEPI Stock Monthly Income Strategy

- Potential for higher returns compared to traditional fixed-income investments.

- Monthly income payments provide consistent cash flow for retirees.

- Diversification of stock holdings reduces overall portfolio risk.

- Opportunity for capital appreciation along with income generation.

Risks of JEPI Stock Monthly Income Strategy

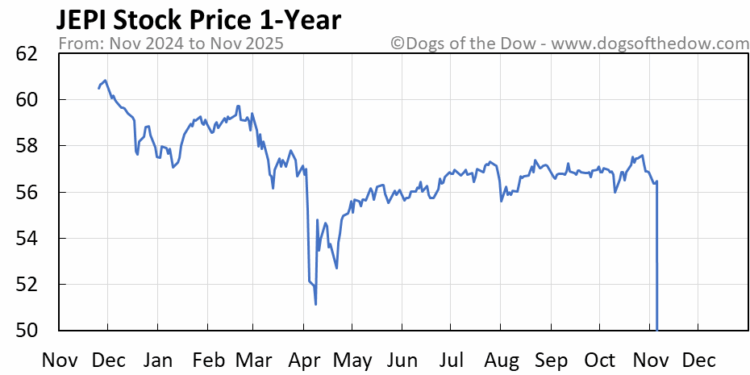

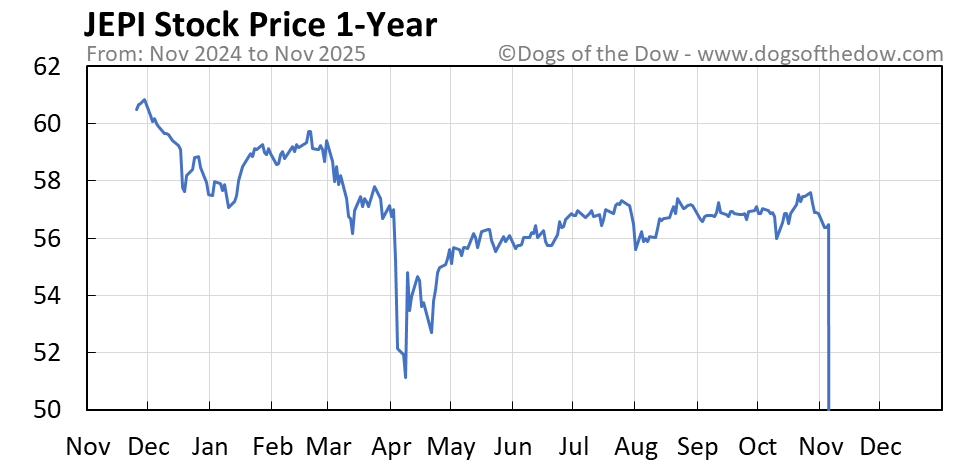

- Volatility in stock prices can lead to fluctuations in income payments.

- Market risk exposes retirees to the possibility of losses in the stock market.

- Dividend cuts or suspensions by companies can impact monthly income levels.

- Requires active monitoring and management to ensure proper balance and risk mitigation.

Comparison with Other Passive Income Strategies

When comparing the benefits and risks of the JEPI Stock Monthly Income Strategy with other passive income strategies, it's important to consider the unique characteristics of each approach. For example, real estate investments may offer more stability but lower returns, while bond investments provide fixed income but limited growth potential.

Case Studies or Examples of Successful Implementation

In this section, we will explore real-life examples of retirees who have successfully utilized the JEPI Stock Monthly Income Strategy to generate passive income for their retirement. We will delve into their experiences, challenges faced, outcomes achieved, and extract valuable lessons and tips for optimizing the strategy based on these case studies.

Case Study 1: Mr. Smith

Mr. Smith, a retiree, decided to invest in the JEPI Stock Monthly Income Strategy to supplement his retirement income. He carefully selected a diversified portfolio of dividend-paying stocks recommended by the strategy. Despite initial market volatility, Mr. Smith stayed committed to the strategy and reinvested his dividends.

Over time, he saw a steady increase in his monthly income, providing financial stability during retirement.

Case Study 2: Mrs. Johnson

Mrs. Johnson, another retiree, faced challenges initially when implementing the JEPI Stock Monthly Income Strategy. She struggled with selecting the right stocks and managing her portfolio efficiently. However, with guidance from financial advisors and online resources, Mrs. Johnson adjusted her strategy, focusing on high-quality dividend stocks.

As a result, she was able to achieve a consistent monthly income stream, allowing her to enjoy her retirement without financial worries.

Lessons Learned and Tips for Optimization

- Conduct thorough research on dividend-paying stocks before investing to build a well-diversified portfolio.

- Stay committed to the strategy and avoid making impulsive decisions based on short-term market fluctuations.

- Reinvest dividends to benefit from compounding and maximize long-term returns.

- Seek guidance from financial professionals or use online resources to enhance your understanding of the strategy.

- Regularly review and adjust your portfolio to ensure it aligns with your financial goals and risk tolerance.

Final Conclusion

In conclusion, JEPI Stock Monthly Income Strategy emerges as a promising avenue for retirees looking to secure a steady stream of passive income. The discussion has shed light on its components, benefits, and potential risks, offering a comprehensive understanding for those considering this strategy.

Question Bank

What is JEPI Stock Monthly Income Strategy?

JEPI Stock Monthly Income Strategy is a unique investment approach designed to generate regular passive income for retirees through strategic stock investments.

How does JEPI Stock Monthly Income Strategy differ from traditional investment strategies?

Unlike traditional investment strategies that focus on capital appreciation, JEPI Stock Monthly Income Strategy prioritizes generating consistent monthly income from stock investments.

What are the advantages of using JEPI Stock Monthly Income Strategy for retirees?

The benefits include a reliable income stream, potential for growth, and reduced reliance on market fluctuations for retirement income.

What are the risks associated with JEPI Stock Monthly Income Strategy?

Risks may include market volatility, company-specific risks, and fluctuations in dividend payouts, which retirees need to carefully consider before implementing this strategy.