Exploring the realm of Loan Security Meaning and Examples in Real-World Lending unveils a fascinating journey into the intricacies of financial security. From understanding the essence of loan security to delving into real-world applications, this topic promises insights that are both enlightening and practical.

As we navigate through the nuances of loan security, we're presented with a tapestry of information that sheds light on the symbiotic relationship between lenders and borrowers in safeguarding financial transactions.

Loan Security Definition

Loan security refers to the collateral or assets that a borrower pledges to a lender to secure a loan. In the event that the borrower defaults on the loan, the lender can seize the collateral to recoup the funds loaned.

Having loan security is crucial for both lenders and borrowers. For lenders, it reduces the risk of lending money by providing a form of protection in case the borrower fails to repay the loan. For borrowers, offering collateral can often result in lower interest rates and better loan terms.

Examples of Assets as Loan Security

- Real Estate: Properties such as homes, land, or commercial buildings can be used as collateral for a loan.

- Automobiles: Cars, trucks, or other vehicles can serve as loan security.

- Investment Accounts: Stocks, bonds, or other investment holdings can be pledged as collateral.

- Jewelry and Valuables: Precious metals, gemstones, or high-value items can be used to secure a loan.

- Equipment: Machinery, tools, or other business equipment can be offered as collateral for a business loan.

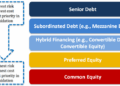

Types of Loan Security

When it comes to securing a loan, there are various types of loan security that lenders may require from borrowers. These security measures provide lenders with a form of guarantee that the loan will be repaid, reducing the risk of default.

Let's explore some of the common types of loan security and the risks associated with each.

Collateral

Collateral is one of the most common forms of loan security. It involves pledging an asset, such as real estate, vehicles, or valuable possessions, to secure the loan. In the event that the borrower fails to repay the loan, the lender has the right to seize and sell the collateral to recover the outstanding debt.

Personal Guarantees

Another type of loan security is a personal guarantee, where a third party agrees to take responsibility for the loan if the borrower defaults. This provides an additional layer of security for the lender, as the guarantor becomes legally obligated to repay the loan in such a scenario.

Secured vs. Unsecured Loans

Secured loans are backed by collateral or personal guarantees, making them less risky for lenders. In contrast, unsecured loans do not require any form of security, relying solely on the borrower's creditworthiness. Unsecured loans typically have higher interest rates to compensate for the increased risk.

Risks Associated with Loan Security

While loan security provides protection for lenders, there are risks involved for borrowers. If a borrower defaults on a secured loan, they risk losing the collateral pledged to secure the loan. Additionally, personal guarantees can put the guarantor's assets at risk if the borrower fails to repay the loan.

On the other hand, unsecured loans carry the risk of higher interest rates and stricter repayment terms due to the lack of collateral.

Factors Influencing Loan Security

When it comes to determining the type of security required for a loan, several factors come into play. These factors can range from the borrower's credit history to the economic conditions at the time of the loan application. Understanding these influences is crucial for both lenders and borrowers to make informed decisions.

Credit History and Loan Amount

One of the primary factors that influence the type of security required for a loan is the borrower's credit history. Lenders often use credit scores to assess the risk associated with lending money to an individual. A higher credit score indicates a lower risk, which may lead to a lower requirement for collateral.

On the other hand, borrowers with lower credit scores may need to provide more substantial security to offset the risk.

Additionally, the loan amount plays a significant role in determining the type of security needed. Larger loan amounts typically require more valuable collateral to secure the loan. This ensures that the lender has adequate protection in case the borrower defaults on the loan.

Economic Conditions

The economic conditions prevailing at the time of the loan application can also impact the choice of loan security. During economic downturns or periods of uncertainty, lenders may be more cautious and require stronger collateral to mitigate potential losses. On the other hand, in a robust economy, lenders may be more lenient with security requirements due to lower perceived risk.

Value of Collateral

When determining the value of collateral needed to secure a loan, lenders typically consider the market value of the assets provided. This valuation process ensures that the collateral is sufficient to cover the loan amount in case of default. Real estate, vehicles, investments, or other valuable assets can be used as collateral, with their value assessed based on current market conditions.

Real-World Examples

Loan security measures in the real world play a crucial role in mitigating risks for lenders and ensuring the repayment of loans. Let's delve into some examples that illustrate how loan security works in practice.

Case Study 1: Mortgage-backed Securities

Mortgage-backed securities (MBS) are a prime example of loan security in action. In this scenario, a financial institution pools together a group of mortgages and sells them to investors as securities. The underlying mortgages serve as collateral for the MBS, providing a level of security for investors.

This practice has evolved over time to become a common method for lenders to reduce risk and generate additional liquidity.

Case Study 2: Asset-based Lending

Another example of loan security can be seen in asset-based lending. In this type of lending, borrowers pledge specific assets, such as inventory, equipment, or accounts receivable, as collateral for a loan. This collateral provides security for the lender in case the borrower defaults on the loan.

Asset-based lending has become increasingly popular in industries such as manufacturing and retail, where tangible assets can be easily valued and monitored.

Role of Loan Security in Specific Industries

Loan security measures play a critical role in mitigating risks for lenders in specific industries. For example, in the real estate industry, mortgage loans are secured by the property itself, reducing the lender's risk of default. Similarly, in the automotive industry, auto loans are often secured by the vehicle being financed, providing a level of security for lenders.

By using specific assets as collateral, lenders can lower their risks and offer more favorable terms to borrowers.

Outcome Summary

In conclusion, Loan Security Meaning and Examples in Real-World Lending serve as pillars of stability in the dynamic landscape of lending practices. By grasping the significance of loan security and its practical implications, individuals can make informed decisions to secure their financial futures with confidence.

Answers to Common Questions

What assets can be used as loan security?

Assets such as real estate, vehicles, or savings accounts can be used as loan security, providing collateral for the lender in case of default.

How do economic conditions impact the choice of loan security?

Economic conditions can influence the value of assets used as security and the overall risk assessment in lending, leading to adjustments in loan security requirements.

What is the role of loan security in mitigating risks for lenders in specific industries?

Loan security helps lenders reduce the risk of financial loss by having assets to recover in case of borrower default, which is crucial in industries with higher inherent risks.