Delving into Mezzanine Debt Investment Strategy: Returns and Risks Explained, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Mezzanine debt is a versatile investment strategy that offers a blend of risk and return. Understanding its intricacies is key to making informed investment decisions. In this discussion, we will explore the nuances of mezzanine debt investments, shedding light on the potential returns and risks involved.

Mezzanine Debt Investment Strategy Overview

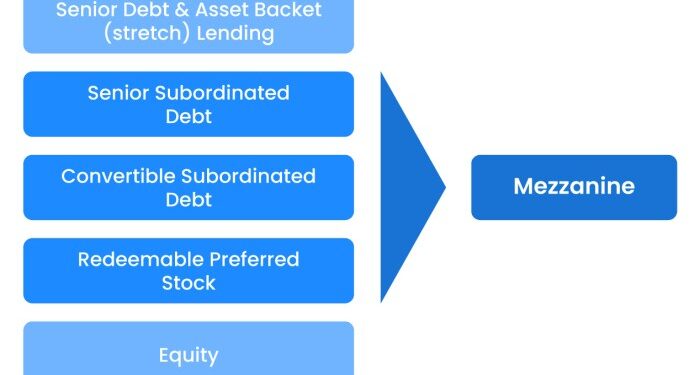

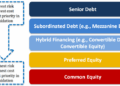

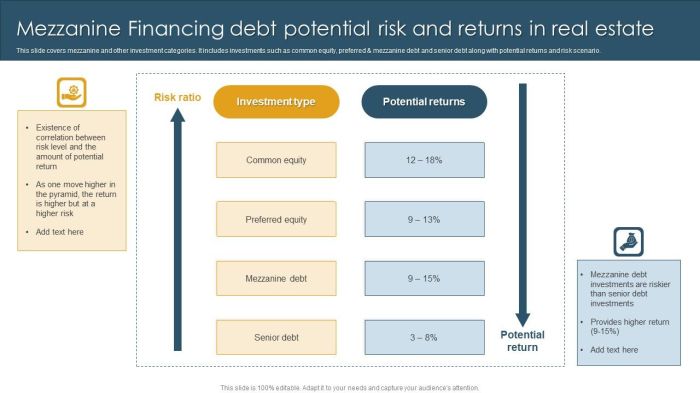

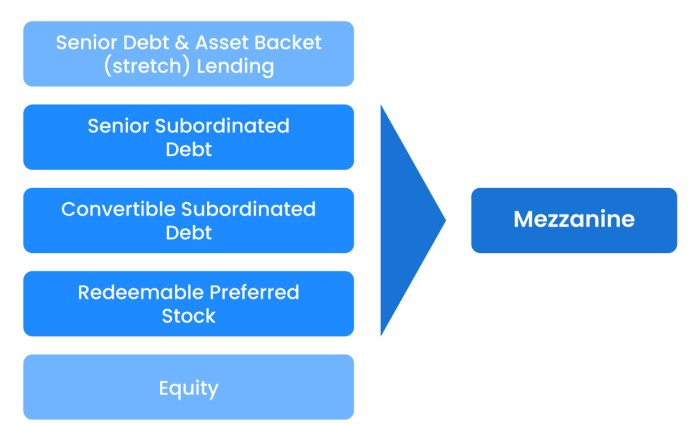

Mezzanine debt is a form of financing that sits between senior debt and equity in the capital structure of a company. It is often used by companies to fund growth, acquisitions, or buyouts.

Characteristics of Mezzanine Debt Investments

- Higher risk compared to senior debt but lower risk than equity

- Typically unsecured and subordinated debt

- Offers a higher potential return than traditional debt instruments

- May include equity kickers such as warrants or options

Examples of Mezzanine Debt in the Capital Structure

Mezzanine debt can be found in various situations within a company's capital structure:

- As part of a leveraged buyout to finance the acquisition

- To fund expansion or growth initiatives

- In recapitalizations to restructure existing debt

Returns Associated with Mezzanine Debt

Mezzanine debt investments offer attractive returns to investors due to the higher risk involved compared to traditional debt investments. These returns are generated through a combination of interest payments, equity participation, and potential upside from successful exits.

Interest Payments

Mezzanine debt investments typically provide investors with regular interest payments, which are higher than what traditional debt instruments offer. These payments are a source of steady income for investors throughout the investment period.

- Interest payments are usually structured as fixed or floating rates, providing a predictable income stream for investors.

- Higher interest rates compensate investors for the increased risk associated with mezzanine debt investments.

- Interest payments are made regularly, either monthly, quarterly, or semi-annually, depending on the terms of the investment.

Equity Participation

In addition to interest payments, mezzanine debt investments often come with equity participation, allowing investors to share in the success of the underlying company. This equity component enhances the overall return potential of the investment.

- Equity participation can take the form of warrants, options, or other equity-like instruments, providing investors with potential upside beyond the fixed interest payments.

- If the company performs well and achieves a successful exit, investors can benefit from capital appreciation through their equity stake.

- This equity kicker differentiates mezzanine debt investments from traditional debt instruments, offering investors the opportunity to participate in the company's growth.

Successful Returns Examples

Successful mezzanine debt investments have resulted in attractive returns for investors, showcasing the potential of this investment strategy. Here are some examples of successful returns from mezzanine debt investments:

"Company XYZ, a technology startup, provided its mezzanine debt investors with a 20% annual return through a combination of interest payments and equity participation. The company's successful exit resulted in a substantial capital gain for investors."

"Private equity firm ABC's mezzanine debt investment in a manufacturing company yielded a 15% annual return for investors. The equity kicker allowed investors to benefit from the company's growth, resulting in a profitable exit."

Risks Involved in Mezzanine Debt Investments

Mezzanine debt investments, while offering attractive returns, come with certain risks that investors should be aware of. Understanding these risks is crucial in making informed investment decisions.

Key Risks Associated with Mezzanine Debt

- Subordination Risk: Mezzanine debt is subordinate to senior debt in the capital structure, meaning in the event of default, senior lenders are repaid before mezzanine lenders. This increases the risk of potential loss for mezzanine debt holders.

- Interest Rate Risk: Mezzanine debt investments are typically floating-rate instruments, making them susceptible to changes in interest rates. An increase in interest rates can negatively impact the returns on mezzanine debt.

- Liquidity Risk: Mezzanine debt investments are not as liquid as other forms of investments, such as stocks or bonds. Exiting a mezzanine debt investment before maturity can be challenging, leading to liquidity risk.

How Risks in Mezzanine Debt Can Be Mitigated

- Diversification: Spreading investments across multiple mezzanine debt opportunities can help mitigate the risk of a single investment underperforming.

- Thorough Due Diligence: Conducting comprehensive due diligence on potential mezzanine debt investments can help identify and mitigate risks before committing capital.

- Covenant Protection: Including protective covenants in the loan agreement can provide safeguards for mezzanine debt investors in case of default or other adverse events.

Factors Influencing Mezzanine Debt Investment Success

Investing in mezzanine debt can be a lucrative strategy, but success is not guaranteed. Several key factors can influence the outcome of mezzanine debt investments, impacting both returns and risks associated with this investment vehicle.

Importance of Due Diligence

Due diligence is crucial in the world of mezzanine debt investments. Conducting thorough research and analysis before committing capital can help investors assess the creditworthiness of the borrower, evaluate the underlying collateral, and understand the terms and conditions of the investment.

By performing due diligence, investors can mitigate risks and increase the chances of achieving favorable returns on their investment.

Market Conditions Impact

Market conditions play a significant role in the performance of mezzanine debt investments. Changes in interest rates, economic conditions, industry trends, and regulatory environment can all impact the success of a mezzanine debt investment strategy. It is essential for investors to stay informed about market dynamics and adjust their investment approach accordingly to navigate through changing market conditions effectively.

End of Discussion

In conclusion, Mezzanine Debt Investment Strategy: Returns and Risks Explained provides a comprehensive insight into this alternative investment approach. By balancing the potential returns with the associated risks, investors can navigate the mezzanine debt landscape more effectively, maximizing their investment opportunities.

Commonly Asked Questions

What is mezzanine debt?

Mezzanine debt is a hybrid form of financing that combines debt and equity elements, often used by companies to fund growth or acquisitions.

How are returns generated from mezzanine debt investments?

Returns from mezzanine debt investments typically come from the interest payments on the debt and potential equity participation in the underlying company.

What are the key risks associated with mezzanine debt?

Key risks include default risk, subordination to senior debt, and market volatility impacting the value of the underlying collateral.

How can risks in mezzanine debt be mitigated?

Risks can be mitigated through thorough due diligence, structuring deals with appropriate safeguards, and diversifying the investment portfolio.