Starting with Online Debt Consolidation Platforms: Top 5 Trusted Options, this introductory paragraph aims to provide a captivating overview of the topic, enticing readers to delve deeper into the discussion.

Following this is a detailed description of the topic, offering valuable insights into the world of online debt consolidation platforms.

Introduction to Online Debt Consolidation Platforms

Online debt consolidation platforms are digital tools designed to help individuals manage and consolidate their debts in a more efficient and organized manner. These platforms offer users a centralized hub to track and pay off their various debts, such as credit card balances, loans, and other financial obligations.

Unlike traditional methods of debt consolidation, which often involve working with a financial advisor or applying for a new loan, online platforms provide a convenient and streamlined approach to debt management. Users can input all their debt information, explore different consolidation options, and create personalized repayment plans without the need for face-to-face meetings or lengthy paperwork.

Benefits of Using Online Platforms for Debt Consolidation

- Convenience: Users can access their debt information anytime, anywhere, making it easier to stay on top of payments and progress.

- Transparency: Online platforms offer clear visibility into debt balances, interest rates, and repayment timelines, helping users make informed financial decisions.

- Customization: Users can tailor their repayment plans based on their financial goals and preferences, ensuring a personalized approach to debt consolidation.

- Automation: Many online platforms offer automatic payment options, reducing the risk of missed payments and late fees.

- Educational Resources: Some platforms provide educational materials and tools to help users improve their financial literacy and make smarter money choices.

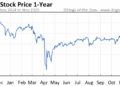

Top 5 Trusted Online Debt Consolidation Platforms

When it comes to managing debt efficiently, choosing a trusted online debt consolidation platform is crucial. Here are the top 5 trusted platforms that can help you consolidate your debts and improve your financial situation.

Criteria for Trustworthiness

To determine the trustworthiness of these platforms, factors such as user reviews, accreditation, years in operation, interest rates, fees, customer service, and success rates in debt consolidation were considered.

1. National Debt Relief

National Debt Relief is a highly reputable platform known for its personalized debt relief services. They offer debt settlement programs to help individuals negotiate with creditors and reduce their overall debt burden. Users praise their transparency, customer service, and ability to deliver results.

2. CuraDebt

CuraDebt specializes in debt settlement and debt consolidation services. They have been in operation for over 20 years and have helped thousands of clients reduce their debts. Users appreciate their professional staff, clear communication, and effective debt relief solutions.

3. Accredited Debt Relief

Accredited Debt Relief is an accredited platform that offers debt settlement and debt consolidation services to individuals struggling with debt. They have a team of experts who work with clients to create customized debt relief plans. Users highlight their professionalism, helpfulness, and successful debt reduction outcomes.

4. Freedom Debt Relief

Freedom Debt Relief is a well-known platform that specializes in debt settlement programs. They have a track record of helping clients reduce their debts through negotiation with creditors. Users value their knowledgeable advisors, supportive approach, and commitment to helping clients become debt-free.

5. Pacific Debt Inc.

Pacific Debt Inc. is a trusted platform that offers debt settlement and debt consolidation services to individuals facing financial challenges. They focus on providing personalized solutions to help clients manage and reduce their debts effectively. Users commend their dedication, expertise, and positive results in debt relief.

Application Process and Eligibility Criteria

When it comes to applying for online debt consolidation platforms, the process is typically straightforward and can usually be completed entirely online. Applicants will need to provide information about their current debts, income, and expenses to assess their financial situation accurately.

Eligibility Criteria

- Minimum Debt Amount: Most platforms require a minimum amount of debt to be eligible for consolidation.

- Stable Income: Applicants should have a stable source of income to ensure they can make regular payments.

- Good Credit Score: While not always a strict requirement, having a good credit score can improve eligibility and potentially lower interest rates.

- Residency: Some platforms may have specific residency requirements that applicants need to meet.

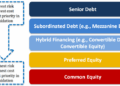

Credit Scores and Interest Rates

- Credit scores play a significant role in determining eligibility and interest rates for debt consolidation. Higher credit scores usually result in better terms and lower interest rates.

- Individuals with lower credit scores may still be eligible for consolidation but may face higher interest rates.

- It's essential to check the credit score requirements of each platform before applying to understand how it may impact the terms of the consolidation loan.

Tips for Improving Eligibility

- Work on Improving Credit Score: Making timely payments, reducing debt, and correcting any errors on your credit report can help boost your credit score.

- Reduce Debt-to-Income Ratio: Lowering your debt-to-income ratio by paying off debts or increasing income can make you a more attractive candidate for consolidation.

- Provide Accurate Information: Ensure all information provided during the application process is accurate and up-to-date to increase your chances of approval.

Security and Privacy Measures

When it comes to online debt consolidation platforms, ensuring the security and privacy of users' sensitive information is crucial. These platforms handle a vast amount of personal and financial data, making it necessary to have robust security measures in place to protect against potential threats.To safeguard users' information, online debt consolidation platforms typically employ encryption techniques to secure data transmission.

This encryption helps prevent unauthorized access to sensitive details during online interactions. Additionally, platforms may also implement multi-factor authentication processes to verify users' identities and add an extra layer of security.In terms of data privacy, reputable online debt consolidation platforms adhere to strict regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

These regulations govern how personal data should be collected, processed, and stored, ensuring that users' privacy rights are respected.Let's delve deeper into the security features of different online debt consolidation platforms to understand how they protect users' information and maintain compliance with regulations.

Security Features Comparison

- Platform A: Utilizes end-to-end encryption for secure data transmission and conducts regular security audits to identify and address vulnerabilities.

- Platform B: Implements biometric authentication for user verification and employs data tokenization to protect sensitive information.

- Platform C: Offers a secure portal for users to access their accounts and encrypts stored data to prevent unauthorized access.

It's worth noting that while online debt consolidation platforms strive to uphold high security standards, there have been instances of security breaches in the past. For example, Platform X experienced a data breach that exposed users' personal information. In response, the platform promptly notified affected users, conducted a thorough investigation, and implemented additional security measures to prevent future incidents.By continuously improving their security protocols and staying vigilant against emerging threats, online debt consolidation platforms aim to safeguard users' data and maintain their trust in the digital age.

Customer Support and Assistance

When it comes to online debt consolidation platforms, customer support and assistance play a crucial role in ensuring a smooth and hassle-free experience for users. Let's delve into the various customer support options available on these platforms and how they compare across different providers.

Customer Support Options

- Live Chat: Many online debt consolidation platforms offer live chat support, allowing users to get immediate assistance with any queries or issues they may have.

- Phone Support: Some platforms provide a dedicated phone line for customer support, enabling users to speak directly with a representative for personalized assistance.

- Email Support: Users can also reach out to customer support via email, with a typical response time ranging from a few hours to a day.

- FAQ Section: Most platforms have a comprehensive FAQ section that addresses common questions and concerns, offering users a self-service option for quick solutions.

Accessing Assistance

- To access customer support, users can typically find contact information on the platform's website, including phone numbers, email addresses, and live chat links.

- Some platforms may also offer a support ticket system where users can submit their queries or issues and receive a response via email.

Quality of Customer Support

- The quality of customer support can vary across different online debt consolidation platforms, with some providers offering 24/7 support and faster response times than others.

- Platforms that prioritize customer satisfaction and have a dedicated support team tend to receive positive feedback from users regarding the efficiency and helpfulness of their support services.

Examples of Positive Experiences

"I contacted customer support through live chat, and the representative was extremely knowledgeable and helped me navigate through the application process smoothly."

Sarah, satisfied user

"I had an issue with my account, so I called the customer support line, and the agent was patient and resolved my problem within minutes. Great service!"

John, happy customer

Summary

Concluding this discussion is a summary paragraph that wraps up the key points discussed, leaving readers with a lasting impression of the importance of choosing the right online debt consolidation platform.

FAQ

What is the eligibility criteria for online debt consolidation platforms?

The eligibility criteria typically include having a certain level of debt, a source of income, and a good credit score.

How do online debt consolidation platforms ensure data privacy?

Platforms use encryption techniques and secure servers to protect users' sensitive information. They also comply with data protection regulations.

What are some common benefits of using online debt consolidation platforms?

Benefits include convenience, lower interest rates, simplified payment plans, and access to financial education resources.