Dive into the world of Revenue Based Financing Calculator: How to Estimate Your Repayment, where we explore the ins and outs of this financial tool in a captivating and informative manner.

Detailing the key components and calculation process, this intro sets the stage for a deep dive into understanding how businesses can benefit from using this calculator.

Introduction to Revenue Based Financing Calculator

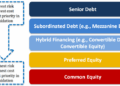

Revenue-based financing is a type of funding where a business receives capital in exchange for a percentage of its future revenue. This model allows businesses to access funding without giving up equity.A revenue-based financing calculator is a tool designed to help businesses estimate their repayment amounts based on their projected revenue and the agreed-upon revenue share percentage.

This calculator provides insights into how much a business may need to repay over time.

Benefits of Using a Revenue Based Financing Calculator

- Allows businesses to plan their finances effectively by understanding their repayment obligations.

- Helps businesses make informed decisions about taking on revenue-based financing by providing clear repayment estimates.

- Enables businesses to assess the impact of different revenue scenarios on their repayment amounts.

- Increases transparency in the funding process by outlining the financial implications of revenue-based financing.

Components of a Revenue Based Financing Calculator

Revenue Based Financing Calculators are essential tools for businesses looking to estimate their repayment amounts. To accurately determine repayment estimates, several key components need to be considered and inputted into the calculator.

Key Inputs Required for Estimating Repayment

- Revenue: The total revenue generated by the business is a crucial input. This helps determine the percentage of revenue that will go towards repayment.

- Financing Amount: The initial amount of financing received from the lender is another important factor. This amount will impact the repayment calculations.

- Repayment Percentage: The percentage of revenue that will be used for repayment is a key parameter. It is usually calculated based on the financing amount and revenue projections.

- Term Length: The length of the repayment term also plays a significant role. A longer term may result in lower monthly repayments but higher overall repayment amounts.

How Components Interact to Determine Repayment Estimates

- Revenue and Repayment Percentage: The higher the revenue, the higher the repayment amount will be. However, a lower repayment percentage can lower the monthly repayment amount.

- Financing Amount and Term Length: A higher financing amount coupled with a longer term length can result in lower monthly repayments but higher overall repayment amounts due to extended interest accrual.

- Overall Impact: All these components interact with each other to determine the final repayment estimates. It is crucial to input accurate data to get a realistic repayment projection.

Understanding the Calculation Process

Using a revenue-based financing calculator involves a step-by-step process to estimate your repayment accurately. Each input plays a crucial role in determining the overall repayment structure. Let's break down the calculation process and understand how each input is utilized.

Step-by-Step Process

- Enter the total amount you are looking to borrow: This is the principal amount you wish to secure through revenue-based financing.

- Input the estimated annual revenue of your business: This figure helps determine the percentage of revenue that will go towards repayment.

- Set the repayment percentage: Based on your revenue and the lender's terms, choose the percentage of revenue that will be used for repayment.

- Specify the term length: Determine the duration over which you will be making repayments, influencing the total amount repaid.

Calculation Examples

When using a revenue-based financing calculator, consider the following scenarios to better grasp the calculation process:

| Scenario | Total Borrowed Amount | Annual Revenue | Repayment Percentage | Term Length |

|---|---|---|---|---|

| Scenario 1 | $100,000 | $500,000 | 10% | 24 months |

| Scenario 2 | $50,000 | $200,000 | 15% | 12 months |

In scenario 1, with a higher total borrowed amount and annual revenue, the repayment percentage is set at 10% over 24 months. This results in a different repayment structure compared to scenario 2, where the parameters vary. By inputting these values into the calculator, you can visualize the repayment schedule and understand how each factor influences the overall repayment amount.

Interpreting the Results

When using the Revenue Based Financing Calculator to estimate your repayment, it's important to understand how to interpret the results provided. These calculations give you insights into the potential repayment structure based on your inputs.The results signify the projected repayment amounts that your business would be expected to pay back over the specified period.

This information is crucial for businesses seeking revenue-based financing as it helps in planning and budgeting for the future.

Comparing Different Repayment Scenarios

- When comparing different repayment scenarios, consider varying inputs such as the loan amount, percentage of revenue, and repayment term.

- A higher loan amount with a lower percentage of revenue may result in higher monthly payments but lower total repayment over time.

- Conversely, a lower loan amount with a higher percentage of revenue could lead to lower monthly payments but higher total repayment due to the increased revenue share.

- By adjusting these inputs in the calculator, you can see how different scenarios impact your repayment amounts and choose the option that best fits your business's financial situation.

Factors Affecting Repayment Estimates

When estimating repayment amounts for Revenue Based Financing, it is crucial to consider various external factors that can significantly impact the accuracy of the calculation. Changes in revenue, growth projections, and market conditions all play a crucial role in determining the repayment estimates for businesses.

Adapting repayment plans based on these fluctuating factors is essential for maintaining financial stability and meeting obligations.

Impact of Revenue Changes

Fluctuations in revenue directly affect the repayment estimates for Revenue Based Financing. A decrease in revenue can result in lower repayment amounts, while an increase in revenue may lead to higher repayments. Businesses must closely monitor their revenue streams and adjust their repayment plans accordingly to ensure they can meet their financial obligations.

Influence of Growth Projections

Growth projections are another key factor that can impact repayment estimates. If a business experiences faster growth than anticipated, they may need to adjust their repayment amounts to accommodate the increased revenue. On the other hand, slower growth may necessitate lower repayment amounts to avoid financial strain.

It is essential for businesses to regularly review and update their growth projections to ensure their repayment plans remain feasible.

Effect of Market Conditions

Market conditions play a significant role in determining the repayment estimates for Revenue Based Financing. Changes in the market can impact a business's revenue streams, which in turn affect their ability to make repayments. Businesses should stay abreast of market trends and adjust their repayment plans accordingly to mitigate any negative impact on their financial health.

Strategies for Adapting Repayment Plans

To navigate the impact of fluctuating factors on repayment estimates, businesses can implement several strategies. These may include renegotiating repayment terms with the financing provider, diversifying revenue streams to minimize risk, or setting aside a contingency fund to cover unexpected changes.

By proactively adapting their repayment plans, businesses can better position themselves to manage uncertainty and maintain financial stability.

Final Summary

Wrapping up our discussion on Revenue Based Financing Calculator: How to Estimate Your Repayment, we've uncovered the essential aspects of using this tool effectively and adapting to changing financial landscapes.

Detailed FAQs

What factors can impact repayment estimates?

External factors like revenue fluctuations, growth projections, and market conditions can significantly influence the accuracy of repayment estimates. Businesses need to adapt their plans accordingly.

How does a revenue-based financing calculator work?

The calculator uses inputs like revenue, financing amount, repayment percentage, and term length to estimate repayments, providing businesses with insights into their financial obligations.

Why is understanding the calculation process important?

Understanding how each input affects the repayment estimate is crucial for businesses to make informed decisions about their financing options and repayment plans.