Revenue Based Financing vs Merchant Cash Advance: What’s the Difference? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

In the world of business financing, understanding the nuances between Revenue Based Financing and Merchant Cash Advance can make a significant impact on decision-making processes and financial outcomes.

Revenue Based Financing

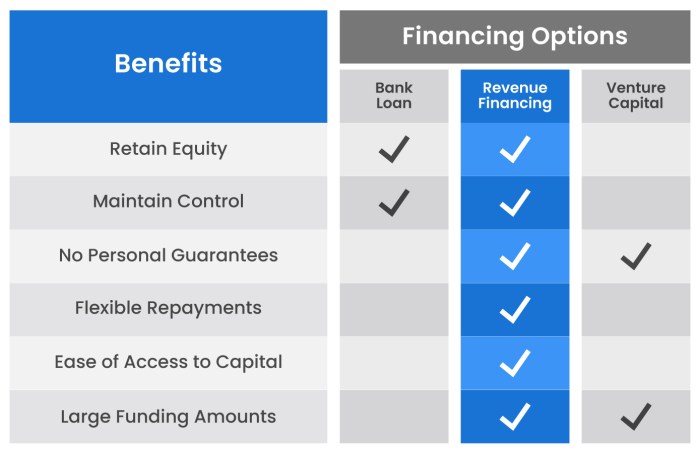

Revenue-based financing is a type of funding where a business receives capital in exchange for a percentage of its future revenue. This differs from traditional loans as repayment is directly tied to the company's income.

Comparison with Traditional Loans

- Unlike traditional loans, revenue-based financing does not require fixed monthly payments.

- With revenue-based financing, the repayment amount fluctuates based on the business's revenue, offering more flexibility.

- Traditional loans typically have a fixed interest rate, while revenue-based financing involves a percentage of revenue as repayment.

Examples of Industries

- Startups and small businesses that have irregular revenue streams often opt for revenue-based financing.

- Technology companies, e-commerce businesses, and service providers commonly use this funding method.

Advantages and Disadvantages

- Advantages:

- Flexible repayment structure based on revenue.

- No fixed monthly payments, which can help during lean periods.

- Quick access to capital without the need for collateral.

- Disadvantages:

- Higher overall cost compared to traditional loans due to revenue-sharing.

- Businesses with high-profit margins may end up paying more than with a traditional loan.

- Complex repayment calculations based on revenue can be challenging to manage.

Merchant Cash Advance

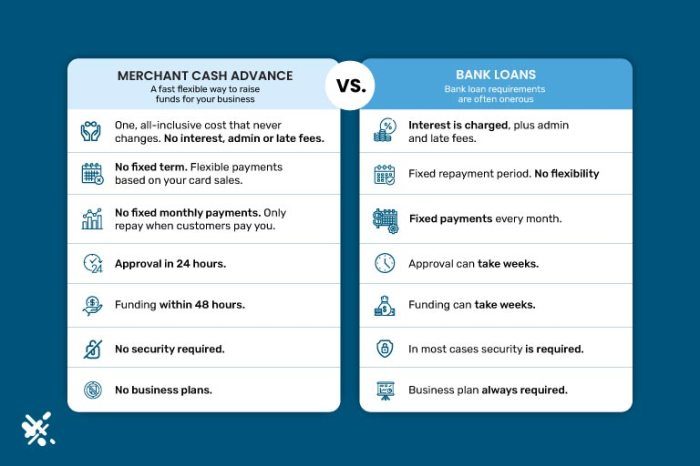

Merchant cash advance is a type of financing where a business receives a lump sum of capital upfront in exchange for a percentage of its daily credit card sales. It is not a loan but rather an advance based on the future revenue of the business.

How Merchant Cash Advances Work

Merchant cash advances work by providing businesses with quick access to funds, typically within a few days. The provider will assess the business's credit card sales and determine the amount of the advance. In return, the business agrees to repay the advance plus a fee by giving the provider a percentage of its daily credit card sales until the total amount is repaid.

- Quick access to funds

- Repayment through daily credit card sales

- High fees and factor rates

Rather than fixed monthly payments, repayments fluctuate based on the business's daily sales volume.

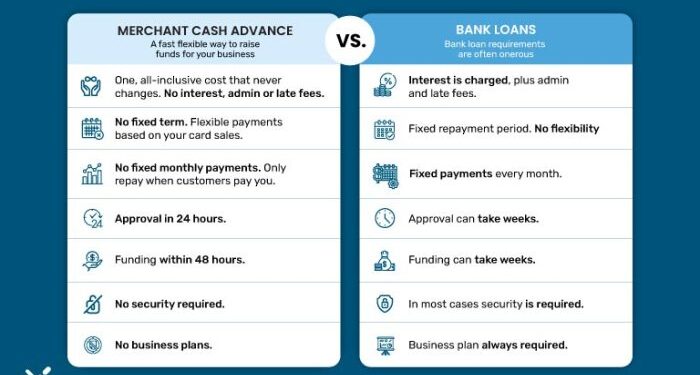

Comparison with Other Business Financing

When compared to traditional loans, merchant cash advances have higher fees and factor rates, making them a more expensive form of financing. However, they are easier to qualify for and provide quick access to funds, which can be beneficial for businesses with immediate cash flow needs.

- Higher fees and factor rates

- Easier qualification process

- Quick access to funds

Risks Associated with Merchant Cash Advances

While merchant cash advances offer fast access to capital, they come with significant risks for businesses. The high fees and daily repayment structure can put a strain on cash flow, potentially leading to financial difficulties. Additionally, if the business experiences a decline in credit card sales, it may struggle to meet the repayment obligations, leading to further financial stress.

- High fees and factor rates

- Strain on cash flow

- Risk of default in case of sales decline

Difference in Structure

Revenue-based financing and merchant cash advances differ in their structures, impacting how they are repaid and how funding amounts are determined.

Repayment Terms

- Revenue-based Financing:

- Repayment is based on a percentage of the borrower's daily or monthly revenue.

- The repayment term is typically longer, ranging from 6 months to 5 years.

- Payments fluctuate based on the business's revenue, providing flexibility during slow periods.

- Merchant Cash Advance:

- Repayment is structured as a fixed daily or weekly deduction from the business's sales.

- The repayment term is shorter, often between 3 to 18 months.

- Payments are fixed, regardless of the business's revenue, which can be challenging during slow periods.

Funding Amount Determination

- Revenue-based Financing:

- The funding amount is determined by analyzing the business's historical revenue and projecting future income.

- Lenders typically offer a percentage of the business's annual revenue, ranging from 10% to 30%.

- The funding amount can be substantial, depending on the business's revenue performance.

- Merchant Cash Advance:

- The funding amount is based on the business's credit card sales and overall revenue.

- Lenders typically provide a lump sum amount based on the business's average monthly sales.

- The funding amount is usually smaller compared to revenue-based financing, but it is accessible to businesses with consistent credit card sales.

Eligibility and Requirements

When it comes to revenue-based financing and merchant cash advances, there are specific eligibility criteria and requirements that businesses need to meet in order to qualify for these financing options.

Eligibility for Revenue-Based Financing

- Minimum monthly revenue threshold

- Stable revenue history

- Good credit score

Documentation and Application Process for Revenue-Based Financing

- Business financial statements

- Bank statements

- Tax returns

- Online application form

Qualifications for Revenue-Based Financing

- Established business with consistent revenue

- Good credit score

- Positive cash flow

Eligibility for Merchant Cash Advance

- Minimum credit card sales volume

- Length of time in business

- No recent bankruptcies

Documentation and Application Process for Merchant Cash Advance

- Credit card processing statements

- Bank statements

- Business tax returns

- Application form

Qualifications for Merchant Cash Advance

- Businesses that primarily process credit card sales

- Regular cash flow

- No recent bankruptcies or liens

Impact on Business

Revenue-based financing and merchant cash advances can have significant impacts on a business's cash flow and overall financial health. Let's delve into the implications of choosing one financing option over the other and explore real-world examples of businesses that have experienced either benefits or challenges.

Cash Flow Impact

- Revenue-based financing: This option typically involves a fixed percentage of the business's daily or monthly revenue being used to repay the financing. This can impact cash flow by reducing the amount of cash available for day-to-day operations or future investments.

- Merchant cash advance: With this option, repayments are made as a percentage of daily credit card sales. While this can provide flexibility during slower sales periods, it may put a strain on cash flow when sales are high.

Financial Health Implications

- Choosing revenue-based financing may result in a more predictable repayment schedule, which can help with budgeting and financial planning. However, it may also limit the business's ability to invest in growth opportunities due to the fixed repayment percentage.

- Opting for a merchant cash advance could provide quick access to funds without the need for collateral or a strong credit history. Still, the higher fees associated with this type of financing can eat into profits and impact long-term financial health.

Real-World Examples

- Company A opted for revenue-based financing to fund a new product launch. While the predictable repayments helped with budgeting, the fixed percentage of revenue limited their ability to expand into new markets.

- On the other hand, Company B chose a merchant cash advance to cover a cash flow gap during a slow season. While the quick access to funds was beneficial, the high fees associated with the advance strained their cash flow in the long run.

End of Discussion

As we conclude this exploration into Revenue Based Financing and Merchant Cash Advance, it's clear that these two financing options offer unique benefits and drawbacks. By weighing the differences in structure, eligibility requirements, and impact on business, individuals can make informed choices that align with their financial goals.

FAQ Section

What are the main differences between Revenue Based Financing and Merchant Cash Advance?

Revenue Based Financing is based on a percentage of a company's future revenue, while Merchant Cash Advance provides a lump sum upfront based on future credit card sales.

What are the risks associated with Merchant Cash Advances?

Merchant Cash Advances often come with high factor rates and can result in a heavy financial burden on businesses with fluctuating sales.

How do the repayment terms differ between Revenue Based Financing and Merchant Cash Advance?

Revenue Based Financing typically involves a fixed percentage of daily or weekly revenue, while Merchant Cash Advances require a fixed daily or weekly payment regardless of sales.

What industries commonly use Revenue Based Financing?

Retail, restaurant, and e-commerce industries are known to frequently utilize Revenue Based Financing to manage cash flow and support growth initiatives.

What are the eligibility criteria for Merchant Cash Advances?

Merchants typically need to have a minimum credit card sales volume and a certain time in business to qualify for a Merchant Cash Advance.