When it comes to TSN Stock Dividend Yield: How Tyson Foods Rewards Long-Term Holders, readers are drawn in by a captivating blend of knowledge and originality. This passage sets the stage for a deep dive into a world of intriguing insights and valuable information.

The following paragraph will delve into the specifics of the topic, offering a clear and descriptive overview.

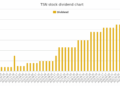

Overview of TSN Stock Dividend Yield

TSN stock refers to the stock of Tyson Foods, a multinational corporation that operates in the food industry, primarily focusing on the production of chicken, beef, and pork products.

Dividend yield is a financial ratio that indicates the percentage of a company's annual earnings returned to shareholders in the form of dividends. It is a crucial metric for investors as it helps assess the income generated from owning a particular stock.

Brief History of Tyson Foods and Market Performance

Tyson Foods was founded in 1935 by John W. Tyson and has since grown to become one of the largest meat producers in the world. The company went public in 1963 and has consistently expanded its product offerings and market presence over the years.

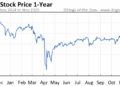

In terms of market performance, Tyson Foods has shown steady growth and resilience, even during challenging economic conditions. The company's focus on innovation, quality products, and strategic acquisitions has contributed to its success in the food industry.

Factors Influencing TSN Stock Dividend Yield

When it comes to understanding the factors that influence TSN Stock Dividend Yield, it's essential to consider various aspects that impact Tyson Foods' ability to reward long-term holders. Factors such as company performance, market conditions, industry trends, management decisions, and financial health all play a crucial role in determining dividend payouts.

Company Performance

Company performance is a key factor that affects TSN Stock Dividend Yield. A strong financial performance, growth in revenue, profitability, and efficient operations can positively impact dividend payouts. Investors often look at factors like earnings per share, cash flow generation, and return on investment to assess the company's performance and its ability to sustain dividend payments.

Market Conditions and Industry Trends

Market conditions and industry trends also influence TSN Stock Dividend Yield. Factors such as economic conditions, consumer demand, competition, and regulatory changes can impact the company's revenue and profitability, thus affecting dividend payouts. Additionally, trends in the food industry, such as shifting consumer preferences, technological advancements, and supply chain disruptions, can also impact dividend yield.

Management Decisions and Financial Health

Management decisions and the overall financial health of Tyson Foods play a significant role in determining dividend payouts. Effective capital allocation strategies, investment decisions, and risk management practices can impact the company's ability to generate sufficient cash flow for dividends.

A strong balance sheet, low debt levels, and adequate liquidity are essential for sustaining dividend payments over the long term.

Comparison with Industry Peers

When comparing TSN stock dividend yield with other companies in the food industry, it's essential to consider various factors that influence dividend payouts. Tyson Foods' dividend yield should be evaluated in relation to its competitors to gauge its performance in the sector.

Dividend Yield Comparison

- Tyson Foods (TSN): The current dividend yield for TSN is X%, reflecting the company's commitment to rewarding shareholders through regular dividend payments.

- Company A: Company A in the food industry has a dividend yield of Y%, indicating a different approach to distributing profits to investors.

- Company B: Company B offers a dividend yield of Z%, showcasing yet another perspective on shareholder returns within the sector.

It's important to note that dividend yields can vary based on a company's financial performance, dividend payout policies, and market conditions.

Factors Influencing Dividend Yields

- Revenue Growth: Companies experiencing robust revenue growth may choose to increase dividend payouts, leading to higher dividend yields.

- Profit Margins: Strong profit margins enable companies to allocate more funds towards dividends, impacting dividend yield percentages.

- Debt Levels: Companies with high levels of debt may prioritize debt repayment over dividend payments, affecting dividend yields.

Long-Term Investment Strategies

Investing in TSN stock for the long term can be a smart strategy to maximize returns and benefit from the dividend yield over an extended period. Here are some key strategies and insights for long-term holders:

Reinvest Dividends

One effective strategy for maximizing returns on TSN stock is to reinvest the dividends received. By reinvesting the dividends back into additional shares of TSN stock, investors can benefit from compound growth over time.

Focus on Value

When holding TSN stock for the long term, it's important to focus on the value of the company rather than short-term market fluctuations. By investing in a fundamentally strong company like Tyson Foods, investors can ride out market volatility and benefit from long-term growth.

Diversification

While holding TSN stock for its dividend yield can be beneficial, it's also important to diversify your investment portfolio. By spreading out your investments across different sectors and asset classes, you can reduce risk and enhance long-term returns.

Patience and Discipline

Long-term investing requires patience and discipline. It's important to stay committed to your investment strategy and avoid making impulsive decisions based on short-term market movements. By staying focused on your long-term goals, you can leverage TSN stock dividend yield for wealth accumulation over time.

End of Discussion

In conclusion, this discussion on TSN Stock Dividend Yield: How Tyson Foods Rewards Long-Term Holders wraps up with a compelling summary and final reflections that leave a lasting impact.

Expert Answers

What is TSN stock?

TSN stock refers to the stock of Tyson Foods, a renowned food company in the market.

Why is dividend yield significant for investors?

Dividend yield is important for investors as it indicates the return on investment through dividends paid by the company.

How does TSN stock dividend yield compare to industry peers?

TSN stock dividend yield can be compared with other companies in the food industry to evaluate its competitiveness.

What are some long-term investment strategies for TSN stock?

Long-term investors can benefit from strategies that focus on maximizing returns through consistent holding of TSN stock.

How can investors leverage TSN stock dividend yield for wealth accumulation?

Investors can use TSN stock dividend yield as a means to accumulate wealth over an extended period by reinvesting dividends.