Exploring the TSN Stock Outlook 2026 with a focus on Tyson Foods in a Post-Inflation Economy sets the stage for a deep dive into the dynamics of the stock market and economic trends.

Delving into the financial landscape and market positioning of Tyson Foods unveils a compelling narrative of resilience and adaptation in the face of inflation.

Overview of TSN Stock Outlook 2026

Tyson Foods, founded in 1935, is a multinational corporation that operates in the food industry, specializing in meat processing. Over the years, Tyson Foods has grown to become one of the largest meat producers in the world, offering a wide range of products to consumers.The impact of inflation on the stock market, including TSN stock, is significant.

Inflation erodes the purchasing power of consumers, leading to higher costs of goods and services. This can affect companies like Tyson Foods, as they may face increased production costs, which can impact their profitability and stock performance.

Current Market Trends Affecting TSN Stock

- Rising commodity prices: Fluctuations in commodity prices, such as corn and soybeans, can impact Tyson Foods' input costs for animal feed, which in turn affects their overall production costs.

- Consumer demand shifts: Changes in consumer preferences towards healthier food options or plant-based alternatives can influence Tyson Foods' product offerings and market share.

- Supply chain disruptions: Disruptions in the supply chain, such as transportation delays or labor shortages, can impact Tyson Foods' operations and potentially affect their stock performance.

- Regulatory changes: Shifts in government regulations related to food safety, labeling requirements, or environmental policies can impact Tyson Foods' operations and profitability.

Tyson Foods Performance Analysis

In recent years, Tyson Foods has demonstrated a strong financial performance, positioning itself as a key player in the food industry. The company has shown resilience in navigating market challenges and adapting to changing consumer preferences.

Financial Performance Overview

Tyson Foods' financial performance has been robust, with steady revenue growth and profitability. The company has effectively managed costs and optimized its operations to drive bottom-line results. Additionally, Tyson Foods has made strategic investments in research and development, innovation, and sustainability initiatives to enhance its competitive position in the market.

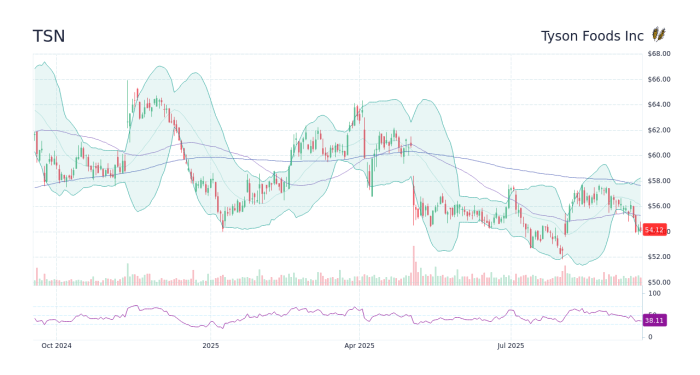

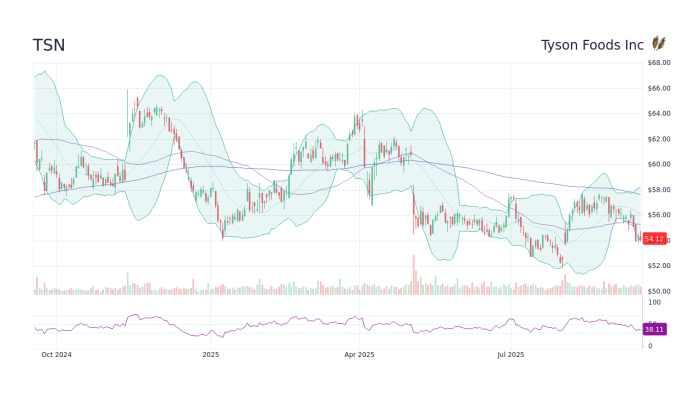

Stock Performance Pre and Post-Inflation

Before the onset of inflation, Tyson Foods' stock exhibited stable growth and value appreciation. However, post-inflation, the company faced some volatility in its stock performance, reflecting broader market uncertainties. Despite this, Tyson Foods has maintained its long-term growth trajectory and remains an attractive investment option for many investors.

Key Factors Influencing Tyson Foods' Stock Outlook

- The impact of inflation on input costs and pricing strategies

- Consumer demand for sustainable and ethically sourced food products

- Global supply chain disruptions and their effect on operations

- Regulatory environment and compliance measures affecting the food industry

- Competitive landscape and market positioning compared to peers

Market Position and Competition

Tyson Foods holds a prominent position in the food industry, known for its diverse portfolio of products ranging from chicken and beef to prepared foods and plant-based alternatives. The company has a strong presence in both retail and foodservice sectors, catering to a wide range of consumer preferences and demands.

Tyson Foods vs Competitors Financial Comparison

When comparing Tyson Foods' financial performance with its competitors, such as Pilgrim's Pride and Sanderson Farms, Tyson Foods stands out with its solid revenue growth and profitability margins. The company's strategic acquisitions and investments in innovation have contributed to its competitive edge in the market.

- Tyson Foods reported a revenue of $46.88 billion in the last fiscal year, showcasing a steady growth trajectory.

- Profit margins of Tyson Foods have remained strong, outperforming many of its competitors in the industry.

- Comparing financial ratios such as Return on Equity (ROE) and Earnings per Share (EPS) reveals Tyson Foods' efficiency and profitability against its peers.

Inflation may pose challenges to Tyson Foods' competitive edge, as rising costs of raw materials and transportation could impact the company's margins and pricing strategies.

Strategies for Navigating a Post-Inflation Economy

In a post-inflation economy, Tyson Foods can implement several strategies to thrive and mitigate inflation-related risks. Diversification can also play a crucial role in helping the company navigate through such economic conditions.

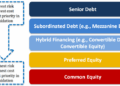

Diversification as a Risk Mitigation Strategy

Diversification involves expanding into different product lines or markets to reduce reliance on a single source of revenue. By diversifying its product portfolio, Tyson Foods can minimize the impact of inflation on specific sectors. For example, the company can invest in plant-based protein products or ready-to-eat meals to cater to changing consumer preferences and offset any price increases in traditional meat products.

Supply Chain Optimization

Optimizing the supply chain can help Tyson Foods mitigate inflation-related risks by reducing costs and improving efficiency. By streamlining processes, negotiating better prices with suppliers, and leveraging technology for inventory management, the company can enhance its resilience to inflationary pressures.

Price Flexibility and Consumer Education

Maintaining price flexibility and educating consumers about the factors influencing pricing can be essential in a post-inflation economy. Tyson Foods can consider implementing dynamic pricing strategies based on market conditions and communicating transparently with consumers about any price adjustments. Educating consumers about the value proposition of their products can help justify price increases and maintain customer loyalty.

Final Summary

As we wrap up our discussion on TSN Stock Outlook 2026: Tyson Foods in a Post-Inflation Economy, the intricate dance between market forces and corporate strategies comes into sharp focus, painting a picture of challenges and opportunities ahead.

Popular Questions

How has inflation impacted Tyson Foods' stock performance?

Inflation has presented challenges for Tyson Foods, but the company has shown resilience in adapting to the changing economic landscape.

What strategies can Tyson Foods employ to thrive in a post-inflation economy?

Tyson Foods can consider diversification, cost-cutting measures, and strategic partnerships to navigate the challenges of a post-inflation economy.

How does Tyson Foods compare to its competitors in the food industry?

Tyson Foods' financial performance can be benchmarked against its competitors to gauge its standing in the market and identify areas for improvement.